Tax-smart retirement planning isn’t about choosing between a personal or workplace account—it’s about using both to minimize taxes and maximize long-term flexibility.

Quick Primer: Two Levers, One Outcome

To both save tax now and fund retirement, you usually combine:

- a workplace plan (employer pension/retirement plan; often with employer matching or contributions), and

- a personal account (individual IRA/SIPP/RRSP/etc. with broader investment choice and portability).

General order of operations (applies in most countries):

(1) Grab the employer match first → (2) Pay off high-interest debt → (3) Max out personal tax-advantaged account → (4) Add extra to workplace plan → (5) Use taxable/brokerage for flexibility.

Adjust for your tax rate, job benefits, and investment options.

How Tax Advantages Usually Work

- Pre-tax/Tax-deferred (EET): You get tax relief now; growth compounds tax-deferred; withdrawals in retirement are taxed as income.

- Post-tax/Tax-free (TEE/Roth/TFSA-style): No deduction now; growth and qualified withdrawals are tax-free.

- Employer money: Many workplace plans add employer match or contributions—free return you shouldn’t leave on the table.

- Investment menu: Workplace menus can be limited/fee-heavy; personal accounts often allow broader, lower-cost ETFs/funds.

- Withdrawals: Early withdrawals can trigger penalties/taxes; each country has its own rules and ages.

- Fees: Lower ongoing fees mean more compounding; always compare all-in expense ratios and admin fees.

Note: Limits, ages, and deduction rules change. Always check the latest official guidance in your country.

Country Playbooks

United States — IRA (personal) vs 401(k)/403(b) (workplace)

- Workplace plan:

- Pros: Employer match; high contribution limit; payroll automation; optional Roth and after-tax features; loan provisions in some plans.

- Cons: Investment menu may be narrow; plan-level fees vary.

- Personal plan (Traditional/Roth IRA):

- Pros: Broad investment choice; low-cost ETF access; Roth IRA provides tax-free qualified withdrawals and no lifetime RMDs.

- Cons: Lower annual limit; income phase-outs for deductibility/Roth eligibility.

US decision rule of thumb

- Contribute enough to 401(k)/403(b) to get full match.

- Fund Roth IRA or Traditional IRA (based on current vs expected future tax rate).

- Return to workplace plan up to annual limit.

- Use taxable brokerage for extra savings and flexibility.

Who benefits most

- High tax bracket now → pre-tax 401(k)/Traditional IRA often efficient.

- Expect higher tax later or want flexibility → Roth options (IRA or workplace Roth) add tax diversification.

- Job hoppers/DIY investors → IRAs for portability and choice.

United Kingdom — SIPP (personal) vs Workplace Pension (auto-enrolment)

- Workplace pension:

- Pros: Employer contributions; automatic enrolment; tax relief via payroll; default funds keep it simple.

- Cons: Default funds/charges vary; limited choice in some schemes.

- SIPP (Self-Invested Personal Pension):

- Pros: Broad investment choice; tax relief at your marginal rate; full control over providers and fees.

- Cons: Requires self-management; watch platform/transaction costs.

UK decision rule of thumb

- Contribute to the workplace pension at least to capture full employer contributions.

- Use a SIPP for extra saving, consolidating old pots, or accessing lower-cost trackers.

- Consider ISA alongside pensions for tax-free flexibility (no withdrawal age restrictions).

Who benefits most

- Employees with generous employer contributions → workplace first.

- Contractors/freelancers or fee-sensitive investors → SIPP control + low-fee index ETFs.

- Higher-rate taxpayers → pension tax relief can be powerful (mind annual/tapered allowances).

Canada — RRSP (personal) vs Group RRSP/Pension (workplace) + TFSA

- Workplace plan (Group RRSP/RPP/DC pension):

- Pros: Employer match/contributions; payroll deduction; sometimes institutional funds.

- Cons: Menu/fees vary; less control when changing jobs (transfer options exist).

- RRSP (personal):

- Pros: Tax-deductible contributions; broad investment choice; can convert to RRIF later.

- Cons: Withdrawals taxed as income; contribution room tied to earned income.

- TFSA (complement):

- Tax-free growth and withdrawals; perfect for flexibility/medium-term goals.

Canada decision rule of thumb

- Capture workplace match.

- Use RRSP for tax deferral if you’re in a higher bracket now than later.

- Use TFSA to build tax-free, penalty-free flexibility (pairs well with RRSP).

- Extra? Back to workplace plan or taxable account.

Australia — Personal Super Contributions vs Employer Superannuation

- Employer super:

- Pros: Compulsory employer contributions; salary-sacrifice options; generally low-cost default MySuper funds.

- Cons: Default investment may not match your risk profile; review fees and insurance premiums.

- Personal (concessional/non-concessional) contributions:

- Pros: Potential tax advantages; control of contribution timing; ability to pick competitive funds/industry supers.

- Cons: Annual caps; preservation rules restrict early access.

Australia decision rule of thumb

- Ensure employer super is paid and the fund choice suits your risk/fee needs.

- Consider salary sacrificing (concessional) to lower taxable income if within caps.

- Add non-concessional for faster compounding if you’ve maxed concessional caps.

- Keep an emergency buffer outside super—access is restricted until preservation age conditions are met.

Singapore — SRS (personal) vs CPF (workplace-linked national system)

- CPF (Ordinary/Special/Medisave; CPF LIFE for retirement income):

- Pros: Mandatory employer/employee contributions; stable base for retirement and healthcare; risk-managed.

- Cons: Limited investment choice; locked for long-term purposes.

- SRS (Supplementary Retirement Scheme):

- Pros: Tax deferral on contributions (subject to caps); broad investment menu (funds, ETFs, etc.); complements CPF.

- Cons: Withdrawal rules/penalties before statutory retirement age; investment risk is on you.

Singapore decision rule of thumb

- Treat CPF as your guaranteed core.

- Use SRS to reduce current taxable income and invest for higher expected returns.

- Keep liquid savings outside SRS for short-term needs.

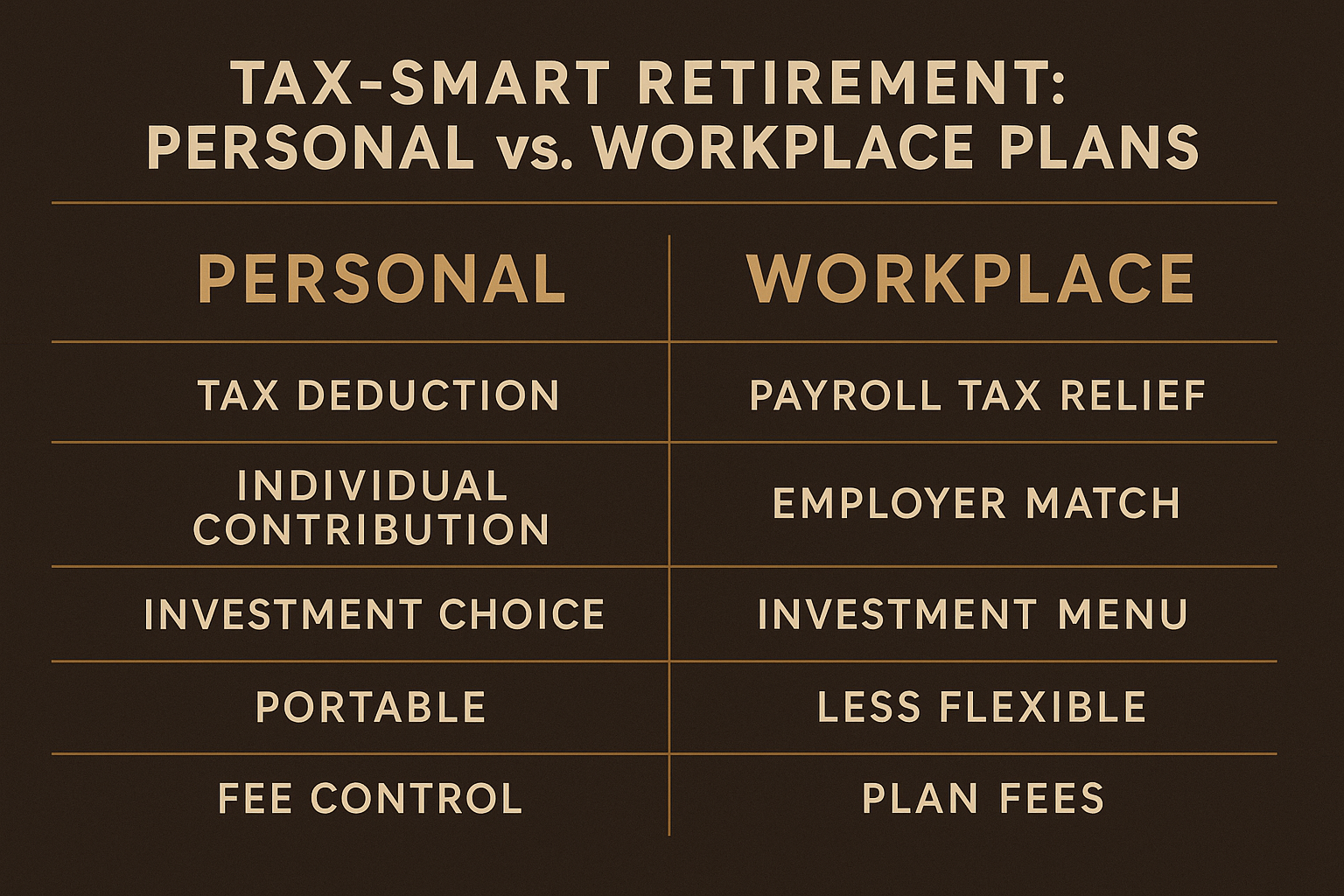

Side-by-Side Snapshot (Conceptual)

| Feature | Personal Account (IRA/SIPP/RRSP/SRS/etc.) | Workplace Plan (401k/Workplace Pension/Group RRSP/Super/CPF) |

|---|---|---|

| Tax benefit timing | Often deduction/relief now (or Roth/TFSA-style later) | Payroll relief + employer money |

| Employer match | No | Frequently yes (major advantage) |

| Investment choice | Broad, DIY, low-cost ETFs possible | Menu varies; sometimes limited |

| Fees | You control provider/ETF costs | Plan admin + fund fees; compare |

| Portability | High across jobs/providers | Transfer/consolidation rules apply |

| Early access | Typically restricted/penalized | Typically restricted/penalized |

Practical Flowcharts (Text Version)

If you are an employee with a match

→ Contribute to workplace plan up to full match → Open/fund a personal account (IRA/SIPP/RRSP/SRS) → Return to workplace up to annual limit → Build taxable flexibility.

If you are self-employed/freelance

→ Open a suitable personal retirement account (country-specific) → If eligible, set up a self-employed/workplace-equivalent plan → Prioritize accounts with the best tax relief and lowest fees.

If you expect higher taxes later

→ Emphasize Roth/TFSA-like options (tax-free withdrawals) for diversification.

If cash flow is tight

→ At minimum, capture employer match (it’s an instant, risk-free return) and automate small contributions to personal account.

Portfolio & Risk Guidelines

- Glidepath: More equities when young; gradually add bonds/defensives as retirement nears.

- Costs matter: Prefer broad, low-fee index funds/ETFs; every 0.50% you save compounding over decades is meaningful.

- Rebalance: Annually or when allocations drift 5–10 percentage points.

- Tax diversification: Mix pre-tax and post-tax (Roth/TFSA-style) buckets to control future tax bills.

- Emergency fund: Keep 3–6 months’ expenses outside retirement wrappers.

Worked Example (Simple Math)

- You contribute $10,000 to a pre-tax/workplace plan at a 24% marginal tax rate → immediate $2,400 tax saved (or deferred).

- An employer match of 4% on salary (say $3,000) adds $3,000 you wouldn’t otherwise receive.

- Invested at a hypothetical 6% annual return for 25 years, the combined contributions compound dramatically—while your present-day tax bill is lower.

(Illustrative only; not a guarantee of returns.)

Compliance & When to Get Advice

- Rules (ages, caps, relief, penalties) change.

- Complex cases—high earners, business owners, cross-border moves, stock options—should consult a licensed adviser in their jurisdiction.

- Always verify current contribution limits and tax policies via official sites.

TL;DR

- Don’t choose one; coordinate both. Take the workplace plan for free employer money and tax relief, and a personal account for control, low fees, and flexibility.

- Sequence: Match → Personal account → More workplace → Taxable.

- Keep fees low, diversify, rebalance, and maintain a cash buffer.

CTA ideas (monetization-friendly, edit to your affiliate partners)

Portfolio templates (global stock/bond ETF mixes) for different risk levels.

Build a retirement plan in 15 minutes: compare low-fee brokers and robo-advisors.

Best books on tax-smart investing and retirement drawdown strategies.

FAQ

Q: Should I pick a personal or workplace retirement plan first?

A: Start with the workplace plan to capture employer match, then add a personal account for control and low fees.

Q: How do tax-smart retirement strategies work globally?

A: They combine tax relief today with tax-free growth or withdrawals later, depending on each country’s rules.

- 2025 MAMA AWARDS — Complete Lineup, Categories & What’s New from Hong Kong

- 2025 K-Beauty Trends: Mirror Skin & PDRN Skincare Revolution

- Advanced Korean Skincare Routine (2025): Night & Anti-Aging Care

- Korean Skincare Layering (2025): Intermediate Routine & Hydration Tips for Glowing Skin

- Fix “Indexing Quota Exceeded” in Google Search Console (2025 Guide)